The #1 Place for Long Term Rentals

Welcome to Snow Capped Properties

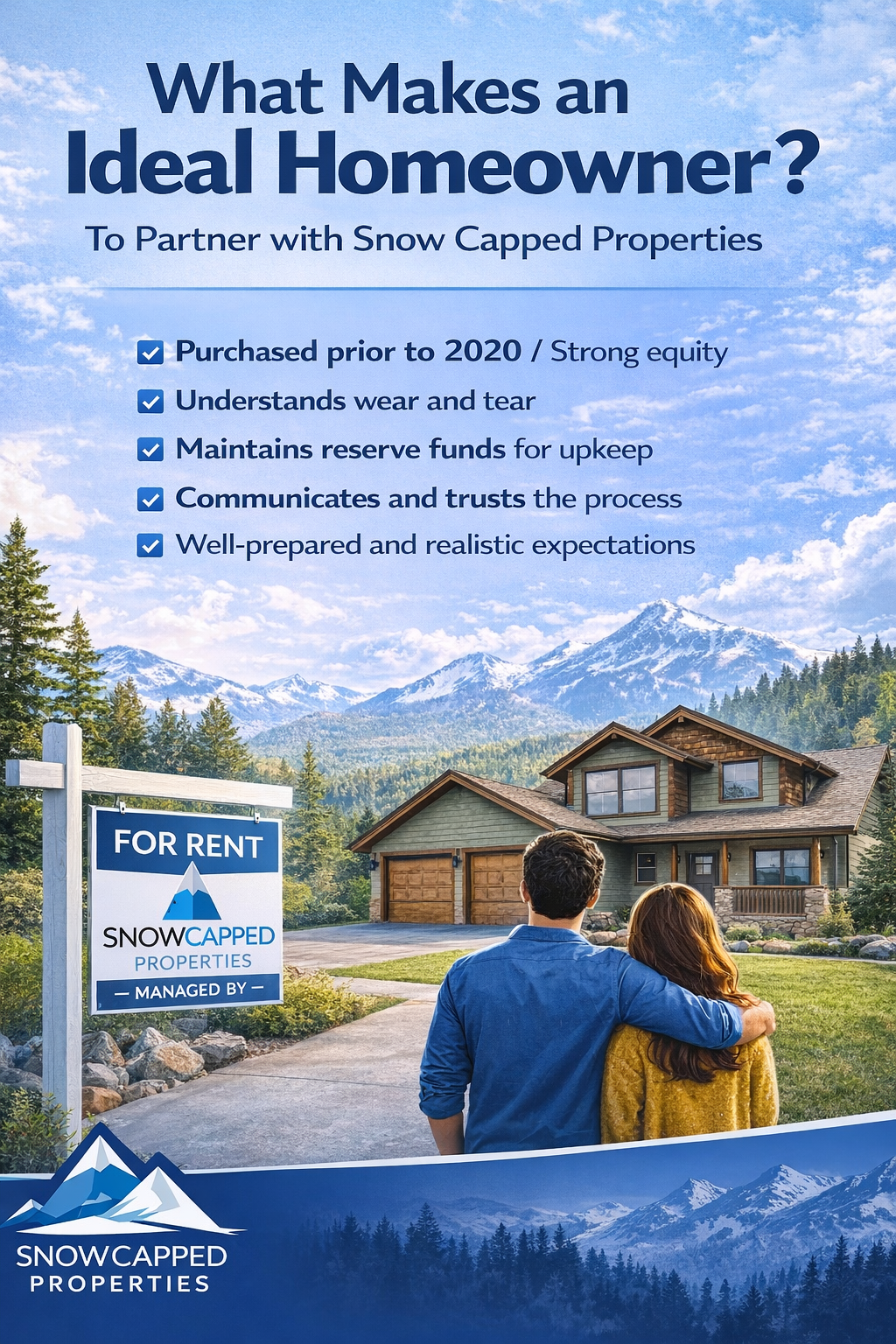

Snow Capped Properties is your dedicated partner in long-term rental management, proudly serving the vibrant communities of Winter Park, Fraser, Tabernash, Granby, Hot Sulphur Springs, and Grand Lake. With a deep-rooted commitment to excellence, we specialize in connecting property owners with reliable tenants while ensuring a seamless rental experience for everyone involved.

At Snow Capped Properties, we believe in achieving your rental goals—TOGETHER. From proactive maintenance and prompt issue resolution to meticulous tenant screening, we handle every detail with care and expertise. Our secure, hassle-free rent collection system ensures timely payments, while our streamlined processes keep your property in top condition. With us, you can expect a smooth, stress-free rental experience that benefits owners, tenants, and the entire community!

25+ Years Experience

100+ Active Units

$80+ Million Managed

List of Services

-

Long Term RentalsList Item 2

Long-term rentals (LTRs) typically involve 12-month leases with locals, providing stable rental income and straightforward management. Tenants usually handle utilities, and HOA fees can be factored into the rent. While LTRs may have lower monthly rates, year-round occupancy, even during off-seasons, balances the income. It's a great option for contributing to the community and ensuring consistent returns.

-

Buy & Sell

Snow Capped Properties offers Grand County homeowners a true one-stop real estate solution. Powered by Jade Real Estate, we uniquely combine property management and real estate sales under one vertically integrated model.

Most agents can sell. Most operators can rent. Very few can do both — strategically and seamlessly.

This integration allows us to adapt in real time to market conditions: selling when pricing is strong, renting when it’s not, and pivoting without disruption. Homeowners are never forced into a single path and always retain flexibility to protect and grow their investment.

With 100+ homeowners, 200+ tenants, and ~1,000 highly-intentional monthly website visitors, Snow Capped delivers exposure beyond the MLS — including renters who later become buyers.

-

Seasonal / Medium Term RentalsList Item 3

We are currently not accepting any new Seasonal rental properties at this time.

This 4-6 month rental option is ideal for summer (June–October) and winter (December–April) seasons, offering higher income than LTRs with some owner use during off-seasons. Tenants, often from Denver, seek vacation homes for skiing or outdoor activities. These rentals are typically furnished, with utilities included, and tend to have less wear-and-tear compared to short-term stays.

-

Corporate Rentals

With the growth in Grand County, businesses often need seasonal or long-term rentals for staff. We specialize in corporate rentals, matching companies with the right properties. We arrange regular mid-stay cleanings, giving homeowners peace of mind and encouraging tenants to care for the space. This proactive approach keeps everyone happy and maintains your property throughout the rental period.